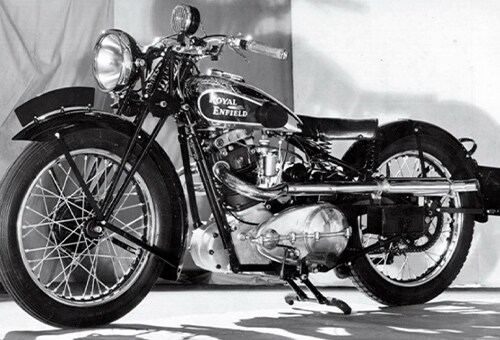

At a time when manufacturers in the domestic motorcycle industry are struggling with slower sales, leisure bike maker Royal Enfield managed to post growth of 45.3 per cent to sell 34,736 units in the first quarter of this calendar year. The company follows a January-December financial year.This came on a low base of 23,899 units sold in the corresponding period last year. Given the niche segment it operates in, the strong demand pull has given Eicher Motors, which owns Enfield, the impetus for a plan to attain global leadership in the mid-size segment over the next few years.Siddharth Lal, managing director and chief executive officer of Eicher Motors, says, “We want to be a global player in the mid-size category and will do whatever it takes to attain that. We want to have a significant share in each country in the world where there is a potential market for mid-sized motor-cycles.”

To power its global ambitions, Enfield has commenced work on new platforms to develop products for markets beyond its traditional stronghold of Europe and America.Exports presently constitute just three per cent of its overall sales, which as of last year was 113,000 units. With the commissioning of a new factory at Oragadam, near Chennai, the company hopes to take export share to at least 10 per cent. Built for Rs 150 crore, the new plant has an initial installed capacity to produce 150,000 units annually, being enhanced to roll out 250,000 units yearly by 2014. The company hopes for an annual production of 500,000 units in the next few years, with additional capacity at its older facility.

For the current year, Enfield has revised upwards its sales estimate to 175,000 units as against 150,000 projected earlier, due to strong demand for its products in the domestic market. By the end of next year, the company hopes to achieve sales of 250,000 units.The strong demand has translated into healthy financials for the motorcycle vertical. This arm recorded a rise of 98 per cent in earnings before interest and tax at Rs 53.1 crore, as compared to Rs 26.8 crore in the 2012 quarter. With initiatives in place to contain costs, Enfield posted a record quarterly margin of 15.9 per cent.VE Commercial Vehicles, the 50-50 joint venture between Eicher and Volvo, managed to improve its market share to 13.9 per cent during the quarter from 11.1 per cent a year earlier. Said Lal, “Given the overall market conditions, with sales sharply dropping in the industry, VECV has done extremely well in gaining market share across every single segment we operate in, as well as a very maintaining a very healthy operating margin in these type of circumstances.”

The margins for VECV dropped to 6.4 per cent during the quarter as compared to 9.1 per cent in 2012, largely due to pressure on volumes and and discounts.Overall, the company registered sales of 12,529 units between January and March, a decline of 12.3 per cent over the 14,289 units sold last year.VECV, however, increased its market share in the 5-14 tonne range to 30.8 per cent (from 29.8 per cent), and in the 16-tonne and above heavy truck segment to 12.3 per cent (from 9.3 per cent) in the period under review.Vinod Aggarwal, chief executive officer of VECV, said, “We have been integrating the best practices of Volvo with our expertise in frugal engineering. We are upgrading our entire product range in collaboration with Volvo. These vehicles will be introduced by the end of this year and would be exported to markets in South Africa and Southeast Asia.” With the new product range in place, VECV has a target of 100,000 unit sales of trucks and buses by 2015.The ratio of exports in VECV’s total sales is also expected to go up to 12-15 per cent over the next two to three years because of the new product interventions. Exports currently constitute four per cent of overall sales for the company.VECV has invested Rs 1,300 crore in India since the JV’s formation in 2008. The plan is to infuse another Rs 1,200 crore till 2015 to meet the requirement of ongoing projects, in setting up an engine manufacturing unit, a bus body building facility, in developing new products and in expanding capacity expansion by 45 per cent to 8,000 units a month by 2015.

Read More : https://www.zigwheels.com/news-features/news/2018-royal-enfield-himalayan-odyssey-flagged-off/30665/

Comments